Produced by Linh Trinh

Produced by Linh Trinh

from Vietnam

MA Marketing Communications

Like many international students living and studying abroad for the first time, I was struggled at first to manage my living costs when I came to the UK. After few months of adjusting to my new life, I have experienced and collected some useful tips that may help new students prepare for their upcoming journeys in the UK. I am Linh, a Vietnamese student studying MA Marketing Communications at Bournemouth University, and here are my top tips when it comes to managing your living cost while studying abroad.

Make the most of internet search

Money, budgeting, and how to manage your living expenses are always one of the most concerning problems for international students when studying abroad. However, there are lots of websites and resources that can make it easier for you to plan and manage your monthly expenses.

My first piece of advice is to look for information on your university website. Regarding the rent, most UK universities offer student accommodation with various options at different prices so you can consider which option is best suited for you. For example, Bournemouth University offers accommodation options ranging from £132 to £182 per week. Otherwise, websites like SpareRoom, Rightmove, Gumtree also have alternative options if you want to live in a non-university accommodation.

Moreover, Student Budget Calculator is a good tool for you to estimate average monthly expenses based on the location of your university. Most supermarkets like Asda, Lidl, Tesco, Sainsbury’s have websites with public prices for each product. You can also download Uber Eats, Deliveroo, or Just Eat to estimate the price of take-aways and Amazon for online shopping. Most clothing, beauty brands, pharmacies, bus, train services also have information of the product’s price on the website or mobile apps with many discounted offers for students. By spending time doing a little research, you will be able to estimate what you can expect to pay for each month.

Planning and browsing the supermarket website in advance helped me save time

while being better at managing my spending

Track your expenses

If you have already planned your spending, here are the tips to track and spend your money wisely. I much prefer paying by card to cash, so I can look at the bank statement and track the amount of money that I have spent. Digital banks like Monzo, Starling Bank, Revolut have features to help you budget your monthly expense.

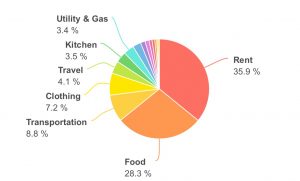

Several mobile applications offer financial managing services that you can use to manage both your income and expense. Currently, I am using Money Mgr. to record my expense daily. My living expenses in Bournemouth range from £700 – £900 per month. At the end of the month, I can easily look at the statistic chart to see how I spent my money in different categories like rent, food, bills, entertainment, shopping, traveling so I can better manage it next month or balance my account whenever I need.

Example of a statistic chart that I use to track my monthly expenses

Ask for advice from current students and university alumni

Expenses vary depending on where you choose to live and how much you want to spend. Seeking advice from alumni or current students can help you gain the most updated information and insights while building connections. For example, if you want to visit local markets but you are not sure about the prices, getting insights from current students can be a great support.

I always reach out to the BU Vietnamese Student Association Facebook group when it comes to enquiries on living in the city. Even after settling down for a few months, I always find it helpful to get support from the university and Vietnamese community at Bournemouth.

I hope that you find this article helpful to best prepare for your upcoming journeys to the UK and I wish you the best in this once-in-a-lifetime experience.

Top 10 coffee spots and eateries in Bournemouth

Top 10 coffee spots and eateries in Bournemouth Malaysian student in Bournemouth: Top 5 experiences!

Malaysian student in Bournemouth: Top 5 experiences! What I learned in my first semester at BU

What I learned in my first semester at BU The beauty of international living

The beauty of international living