Figuring out how to manage finances as a student can be tough, particularly if you’re an NHS student required to participate in mandatory unpaid placements throughout the year. I’ve worked for the NHS as a health care worker for 3 years and have met many students. Alongside this, I am a social work student in my final year, where I had to undertake 70 days and 100 day placements during my second and third year. Therefore, I’d like to share some of my experience and budgeting tips on how to make the most of your student status and finances.

Figuring out how to manage finances as a student can be tough, particularly if you’re an NHS student required to participate in mandatory unpaid placements throughout the year. I’ve worked for the NHS as a health care worker for 3 years and have met many students. Alongside this, I am a social work student in my final year, where I had to undertake 70 days and 100 day placements during my second and third year. Therefore, I’d like to share some of my experience and budgeting tips on how to make the most of your student status and finances.

First, the government have now issued NHS bursaries again for all NHS (and Social Work) courses. This means an additional up to £5,000 yearly gifted to you in recognition that you may not be able to support yourself financially whilst undertaking mandatory placements for weeks and months at a time. The social work bursary is not means tested, whereas the NHS bursary is. You can read more about the eligibility requirements and how much you may be entitled to here: NHS bursaries: What you’ll get – GOV.UK (www.gov.uk). I found this bursary particularly useful, as in my circumstance I receive an additional £4862 across 3 instalments of the year, enablin g me to use it on whatever I wish – mostly my housing costs and bills.

g me to use it on whatever I wish – mostly my housing costs and bills.

If you are enrolled on a registered NHS course that is eligible, you may also be entitled to a Training Grant of £5,000 per academic year, a Parental Support fund of £2,000, and money back for excess travel and temporary accommodation costs whilst you’re on your practice placement. This is particularly useful for those NHS courses that may have placements continuing throughout the summer, where student finance maintenance loans do not initially cover that period.

If you’re an NHS student, particularly a nursing one, you can also apply, for a bank health care assistant role. Under the local trust, you may be eligible to skip the application/interview process and start with an induction. Working as a bank Health Care Assistant, enables you to pick up shifts as and when you may choose to fit around your lifestyle. You can opt to work 0 hours for several weeks at a time, or up to 37.5 hours in a week. I have found this role incredibly flexible and useful to keep me afloat financially whilst on a demanding university course that doesn’t enable me to have a set timetable. You are entitled to weekend and night enhancements and there’s plenty of opportunities to pick up short shifts from 4 hours to long shifts up to 12.5 hours. The role pays weekly also, which I’ve found is great for me to help with my weekly food shop and to top me up before the next maintenance loan comes in. The only request is you work 1 shift every 6 months, however the office will reach out to you before cancelling your contract if you were off for more than 6 months.

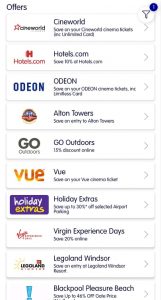

Working for the NHS comes with some perks and benefits. For example, it’s free to access a Blue Light Card. This card entitles you to discounts online and in store at lots of retailers and merchants. For example, between 6 December 2021 and 31 January 2022, Asda groceries and clothing in store were offering 10% discount when shown a Blue Light Card. I’ve also found lots of great deals by showing my NHS ID, from Dominos Pizza, to Easy Jet Holidays, TUI, florists, clothing stores, local bus companies for travel and supermarkets. So, whatever the occasion may be, you can usually find an NHS discount to help aid your budget.

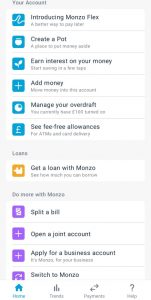

For use of budgeting, I’ve really liked using Monzo bank. I set ‘Money Pots’ up where I can keep money separate from my main account, for when bills are due. I can also use the ‘Split a bill’ option with the app to split a payment with someone else who may have Monzo. You can also set it up so it rounds up each transaction you spend and puts the extra money into a savings account. For example, if your purchase was £7.50, it would round this up to £8 and put the 50p into a savings for you.

Even if you’re not an NHS student, there are still plenty of ways for you to save money and apply for discounts. Student Beans and Totem (NUS) cards are a great way to use discounts, in the same way you would a Blue Light Card. You can also apply for a 16-25 Railcard to save a third off trains when travelling home.

Key advice, is to shop around for deals, and make the most of all the student and NHS offers out there. Work out your incomings vs your outgoings, so when your payments hit the bank you can feel confident at how much ‘change’ you might have left over after the important bills have been accounted for. Finally, grab yourself that bank job! If you’re an NHS student, the experience will be crucial to your learning and help you to grow within your chosen career path, whilst earning some extra cash too.

Key advice, is to shop around for deals, and make the most of all the student and NHS offers out there. Work out your incomings vs your outgoings, so when your payments hit the bank you can feel confident at how much ‘change’ you might have left over after the important bills have been accounted for. Finally, grab yourself that bank job! If you’re an NHS student, the experience will be crucial to your learning and help you to grow within your chosen career path, whilst earning some extra cash too.

Budgeting and saving money as a student

Budgeting and saving money as a student How I manage my student finance

How I manage my student finance Budgeting tips

Budgeting tips All you need to know about applying for the NHS Learning Support Fund

All you need to know about applying for the NHS Learning Support Fund