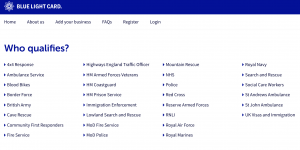

Being a mature student who lives with my own family including a 4-year-old, I have to make sure that my money is organised and that every last penny is budgeted for. On the nursing course, you automatically get an additional NHS bursary to help you whilst on the course and this is, as the student loans, split into 3 equal payments but the dates of these are in between the dates you receive your loans. This really does help with budgeting your money and ensuring that it stretches. Even without these additional payments, the principles still remain the same. You can also get additional bursaries for childcare and claim back travel and accommodation expenses for placements. Also, if you are on an NHS course don’t forget to also ask anywhere you shop if they do NHS or student discounts! The local bus service offers an NHS discount so don’t forget to ask. Have a look at getting a blue light card once you have your NHS ID.

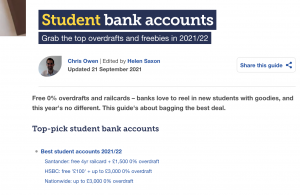

Firstly, I have two accounts. One is for bills and the other is for spending. As a student, you can apply for a student account either with your current bank or with another one that may have a great offer on such as a railcard or interest-free overdraft. Money-saving experts go through each of the banks looking at what they are offering each year and list the best ones on offer. The ones in the picture below are the ones that they picked for this year. As you can see they normally offer an overdraft and some offer additional perks. I would be cautious with the overdraft. Yes it’s free to borrow but it still has to be paid back and you could end up always paying it back each term and starting on a minus. If you think you will be tempted it’s better to decline it.

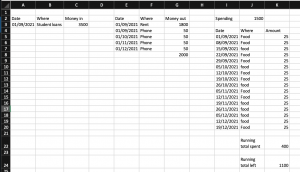

Next, make an excel spreadsheet. You can make it really simple. Money in and the date it comes in. Money out and the date it comes out. From this, you can look at how much money you need to put aside just to cover your bills before your next payment is due from student loans. Below I have done an example. You can edit this with your own figures. Use the sum formula in excel you calculate how much you will need to cover the money going out until your next payment. To calculate spending use the sum formula again and do the total money in minus the total money out. This will let you know how much money you have to spend on food and going out. I would also advise you to set a budget for your food shop and stick to it. Now, this is the most important part and hardest to stick to when you want to go out, stick to your budget! You could potentially add the food shop budget to money out instead and this would leave you with a true spending figure.

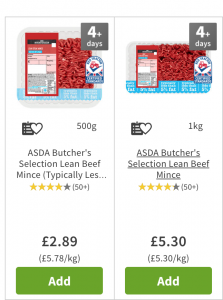

It helps if you meal plan each week and if you can, buy bigger packs and freeze it. For example, 1kg of 5% mince at Asda is around £5.30, this can be split into 4 and make 4 meals and will cost less than buying 42 lots of 500g of mince. So have a look at how much items cost for kg/g and which would be cheaper.

Lastly, once you have this calculated sort out which account will be which. I found my bills and rent etc are already going out of my account so used the new account as my spending account. This ensures you keep your money separate and don’t go over your allowances.

So it is probably not the most advanced way of budgeting but I have found that it’s easy to set up and easy to use and think it would defiantly benefit those who maybe have never lived away from home or struggle to budget. Having the additional payments and budgeting, it has allowed me to have my dream of becoming a nurse. I really hope this helps you budget and in turn, means you can be less stressed and enjoy your social life at uni too.

How I manage my student finance

How I manage my student finance New Year – How to eat healthy on a budget

New Year – How to eat healthy on a budget Nursing student story: from managing finance to overcoming the most challenging year

Nursing student story: from managing finance to overcoming the most challenging year How to save money while at university!

How to save money while at university!