The first stage of applying for student finance is to set up an online account. You can do this through Student Finance England (for students from England). It’s best to apply for your finance when applications open, or as early as you can (for most academic years this is from Ma rch). However, you can still apply for funding up to nine months after the course has started. For most undergraduate courses that start between 1 August and 31 December, you can apply as late as 31 May after your course has started but applying early ensures you have the funds in place for week one in September.

rch). However, you can still apply for funding up to nine months after the course has started. For most undergraduate courses that start between 1 August and 31 December, you can apply as late as 31 May after your course has started but applying early ensures you have the funds in place for week one in September.

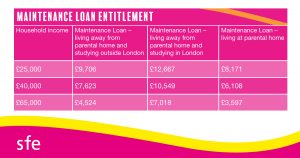

There are two main types of loan available for UK students. The first is a Maintenance Loan to help with living costs, the second is a Tuition Fee Loan for your course fees. You can apply for up to £9,250 to pay for your course fees, which is the full cost of most standard full-time undergraduate courses. This is not means tested. You could be eligible for a Tuition Fee Loan if you’ll be studying at a university or college in the UK, if you’ll be studying a course that qualifies for funding and if this is your first time studying an undergraduate course. When confirming how much you’ll receive for a Maintenance Loan, three factors are considered. These are: your household income from the previous tax year; where you’re studying (L ondon based or not); and if you live with your parents or away from home.

ondon based or not); and if you live with your parents or away from home.

When applying for a Maintenance Loan for a full-time undergraduate course, if you do not provide additional information around household income, you will be entitled to the basic rate. For the academic year 2022-2023, studying outside London and living away from home this is £6,929. The maximum entitlement based on a household income of under £25,000 a year, studying outside London and living away from home for 2022-2023 is £9,706. If you’re under 25, Student Finance England will automatically assess your parents’ income, however if you are over 25, they will assess yours. There are some exceptions, for example if you can prove you have supported yourself financially for the past three years and are under 25, student finance will assess your income. This also applies if you’re under 25 and married.

The Maintenance Loan is paid in three instalments throughout the academic year, 33% of the total paid in September, 33% paid in January and 34% paid in April. The money is paid into a UK bank account of your choice, and you can spend it on whatever you choose to help support you whilst you study, such as rent, book costs, travel costs, food and living costs. There is also extra support available if you have a disability, or dependants who rely on you financially. Your tuition loan is paid directly to the university in instalments, so you do not need to worry about managing these payments  once your application has been approved.

once your application has been approved.

To fill out the application online, you will need: a valid UK passport (or original birth certificate); a valid email address; bank account details; your National Insurance Number; your school, university and course details; your household income; information about any support you receive already. Once you have registered online, filled out the online application, and submitted your household income figures, your parents or partner will then be sent an email to confirm this. The final stage is then to send proof of identity.

A student loan does not need to be repaid until you have completed your course and are earning over a certain amount of money. The amount repaid each month is based on your income, not how much you borrow and fluctuates as your salary increases or decreases. Interest is charged from the first day the first instalment is made to the student until the loan is repaid in full or cancelled. All English or Welsh students who started an undergraduate course anywhere in the UK on or after 1 September 2012 is part of the Plan 2 repayment scheme. Plan 2 loans are written off 30 years after the April you were first due to repay. You’ll repay 9% of the amount you earn over the threshold for Plan 2. The thresholds for this plan are £524 a week or £2,274 a month, before tax and other deductions, and they usually change on 6 April every year. For example, if you were to earn £28,800 a year before tax, your income is £126 a month over the threshold, meaning you will pay back 9% of £126, therefore repaying £11 a month.

Remember, Student Finance England can take up to six weeks to process your application so be sure to give yourself plenty of time to get your application in. I hope this has helped break down the basics of student loans and the application process.

Funding my degree as a Health and Social Sciences student by working too

Funding my degree as a Health and Social Sciences student by working too New Year – How to eat healthy on a budget

New Year – How to eat healthy on a budget A BU Maintenance Bursary made all the difference for Megan’s student experience

A BU Maintenance Bursary made all the difference for Megan’s student experience

Bournemouth University is one of the best educational institutes