Being a student can be difficult especially when it comes to managing finances and dealing with paying rent and buying essential items. During a cost-of-living crisis, it can be tough to budget and cut down, but I am here to share some of my tips with you to help you understand your finances and budget.

One of my first tips for any student is to open up a student bank account. You often get perks with this too, like an interest-free overdraft or a free railcard. It is worth looking at all the different types of student bank accounts out there and seeing what will benefit you.

I love to use my student bank account only for my rent, this helps me visualise how much I’m saving up and I then will not touch this amount as I am using it for my rent. It is important to look in advance how much your rent is and how much you need.

What is student finance? This is a common question. A maintenance loan is for your everyday living expenses like paying rent, food, and other essentials you may need to live. This varies from student to student and often depends on your household income. Your course fees cover your tuition fees for the year. Universities can charge up to £9,250. While this sounds scary, you don’t pay it back straight away and you won’t have to pay anything upfront. You only start to pay it back once you start earning a certain amount, which again varies on how much income you are making.

To apply to student finance, you need to check if you’re eligible first, and then set up a student finance account online and start an application. I would recommend, speaking to those who can support you and look at ways to balance your finances. If you set yourself a budget, ask yourself is achievable. My best advice to any student would be to apply for a job when you have free time and try to save up as much as possible before university.

So, you have money for essentials and just in case. When I applied for student finance last year, I felt overwhelmed with all the information and worried about where I would find the money to help cover rent and living costs.

When I applied for student finance last year, I felt overwhelmed with all the information and worried about where I would find the money to help cover rent and living costs.

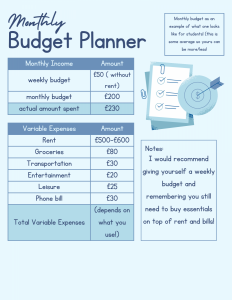

However, I overcame this once I was at university and cut back on expenses and saved up to ensure I could pay rent and make sure that essentials like food came first. Giving myself a weekly budget has helped me achieve this and feel more at ease with managing money.

At Bournemouth University, there is plenty of help for students to help manage finances. There are many services that students can access. If you visit the BU Finical Support page you can see what help is out there for you.

Remember that you are not alone, and finances and loans can be frightening. It’s important to seek help if you need it.

All you need to know about applying for the NHS Learning Support Fund

All you need to know about applying for the NHS Learning Support Fund Opportunities to build intercultural competence while studying at Bournemouth University

Opportunities to build intercultural competence while studying at Bournemouth University My top tips on saving as a student

My top tips on saving as a student Everything you need to know about student bank accounts

Everything you need to know about student bank accounts